Explore web search results related to this domain and discover relevant information.

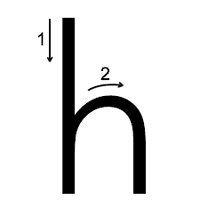

The H pattern usually forms after a large bearish trend and goes up to test its recent decline. It looks like a small letter h on charts.

The H pattern usually emerges after a steep bearish trend and is notable for its distinctive shape, likened to the small letter H. That trend can span anywhere from a few minutes to a few weeks. There is also some controversy and confusion surrounding the H pattern. On January 30th, 2024, I traded and screenshot a textbook h pattern setup on a SPY one-minute chart as it progressed with nearly perfect follow-through.With practice, simply noticing the pattern at a glance will give you all of the information needed to identify price targets and formulate a trade plan. ... One of the most important things to know about the H pattern is that it is often a very short-term reversal.Statistically, it provides opportunities for a bearish trade at the end of the pattern’s development. The formula for analysis involves noting the first low, the first high, and then the second low, following the steep bearish trend’s reaction to a support level or a known demand zone.These price targets can be used to enter and exit a trade or multiple trades. It is also important to recognize that a set of probabilities will accompany each price target. First things first. Identify the H pattern.

The h-pattern stock chart can signal a profitable entry point for traders in a volatile market. What are h-pattern stocks and are they a good investment?

What are h-pattern stocks and are they a good investment? ... June 16 2022, Published 11:12 a.m. ET ... There are many technical patterns that traders study to help inform their moves. Traders have assigned the patterns various names mostly based on their setup to try to make them memorable.The good news is that the price fluctuation often follows certain patterns. Therefore, you can take advantage of the movement in either direction to profit in any market condition. The h-pattern can be an important signal when you’re trying to manage a trade in a volatile market.Many consider the h-shaped chart as a piece of the Head and Shoulder pattern, which some traders also use as a shorting signal. In the Head and Shoulder setup, price actions result in a pattern with a high point sandwiched between the elevated ends that look like a head between shoulders.You may remember the struggle between Wall Street elites and WallStreetBets army in meme stocks GameStop and AMC Theatres. The epic short squeeze cost hedge funds billions of dollars. The massive loss led Citron Research to announce that it would no longer short stocks. ... © Copyright 2025 Market Realist. Market Realist is a registered trademark.

The HH HL LH LL strategy is the foundation of market structure analysis in forex trading. It helps traders identify trend direction and potential reversal points by analyzing the sequence of swing highs and lows that price creates over time.

This strategy is based on Dow Theory principles: an uptrend consists of Higher Highs (HH) and Higher Lows (HL), while a downtrend consists of Lower Highs (LH) and Lower Lows (LL). Understanding these patterns gives traders a clear framework for trend identification and entry timing.Look for failure to make HH followed by break below previous HL (structure break). ... Look for failure to make LL followed by break above previous LH (structure break). ... Reversal trades are higher risk.GBP/JPY 4-hour chart displaying a clear structure break from LH+LL to HL+HH pattern, signaling the end of the downtrend and beginning of new uptrend. ... The most reliable setups occur when market structure is confirmed by other signals like candlestick patterns, momentum divergence, or key support/resistance levels. Never trade based on structure alone.Draw trendlines connecting your swing highs and lows. A break of a valid trendline often coincides with a market structure break, providing another layer of confirmation. Join our community of professional traders and gain access to exclusive strategies, live trade examples, and daily market analysis.

An h-pattern is a chart pattern that emerges when a security that has fallen precipitously later retests the low point of its recent decline, making fresh lows. The pattern begins with a steep decline, followed by a “dead-cat bounce” — meaning the price of a security exhibits an initial ...

An h-pattern is a chart pattern that emerges when a security that has fallen precipitously later retests the low point of its recent decline, making fresh lows. The pattern begins with a steep decline, followed by a “dead-cat bounce” — meaning the price of a security exhibits an initial rebound from its low that lures in bullish traders with the false hope of a continued recovery.The h-pattern appears when market participants rush in to buy a declining security, only to discover that demand for the security is unsustainable. As the momentum behind the rebound wanes, often on low or decreasing trading volume, the same participants then exit their position, fearing that their decision to enter the trade was premature.As a result, the price chart of a security experiencing this three-step price-action will form a pattern that resembles a lower-case "h". Swing traders who look for mean-reversion opportunities will often seek out securities whose charts exhibit break-downs similar to the moves that define the first leg down of an h-pattern.When I discover a chart containing what looks like an emerging h-pattern, I prefer to approach the opportunity with caution, holding off on a trade until the second leg down of the h-pattern breaks the key support level established by the low point of the first leg down.

We find great success when we recognize this particular pattern before it even occurs. It’s called the “h” pattern, it’s rarely used amongst other traders, however The Profit Room’s team can spot this pattern on any time frame. It’s our bread and butter for easy money making.

The pattern occurs when the stock has a steep or sudden decline followed by a very weak bounce (all the following candles are inside bars) As the bounce begins to fail, the price formation resembles a lower-case “h”. Many technical traders will trade any pattern based on a break.As in the break of support. We like to enter a trade before the break of support. It’s all in anticipation! With the h pattern, you will enter the short at the top/curve of the highs, with a stop way above the highest candle. As the stock begins to drop, you can add to your position.The large red bar is the result of technical traders entering this position at the break of support – this trade resulted in a $22/share move from our short call ... Preferably, a daily chart “h” pattern will result in substantial gains.In early 2014 The founders of The Profit Room made the h pattern a trend amongst many traders that crossed their path.

High-frequency trading (HFT) is algorithmic trading characterized by high-speed trade execution, an extremely large number of transactions, and a very short-term investment horizon. HFT leverages special computers to achieve the highest speed of trade execution possible.

Trading algorithms can scan multiple markets and exchanges. It enables traders to find more trading opportunities, including arbitraging slight price differences for the same asset as traded on different exchanges. Many proponents of high-frequency trading argue that it enhances liquidity in the market.The risk can be mitigated with several strategies – one of which is stop-loss order, which will ensure that a trader’s position will close at a specific price and prevent further loss. High-frequency trading remains a controversial activity and there is little consensus about it among regulators, finance professionals, and scholars.The ratio is much greater than the classic investor who invests with a long-term strategy. A high-frequency trader will sometimes only profit a fraction of a cent, which is all they need to make gains throughout the day but also increases the chances of a significant loss.One major criticism of HFT is that it only creates “ghost liquidity” in the market. HFT opponents point out that the liquidity created is not “real” because the securities are only held for a few seconds. Before a regular investor can buy the security, it’s already been traded multiple times among high-frequency traders.

The H-pattern is a chart formation that appears when a security, having sharply fallen, revisits the lowest point of its recent downturn and then proceeds to establish new lows.

Download and Trade Now! ... Trading on the Cryptocurrency markets implies the utilisation of various chart patterns. Many of these patterns resemble letters from the alphabet, such as ‘M’ shaped tops or ‘U’, ‘V’, ‘W’ shaped bottoms. The H-pattern is one of the technical indicators many traders and analysts resort to when setting out their trading strategy, to harness the profit opportunities a vibrant market has to offer.An H-pattern reflects a lower case letter ‘h’ on the chart and typically indicates a steep decline of the assets price, followed by a short rebound and a subsequent continued downward trend. This three step price action pattern is a bearish indicator and is often considered a shorting signal when traders expect a market decline, with the asset reaching fresh lows.The H-pattern is a bearish chart pattern that resembles a letter ‘h’ upon its formation and can be an effective tool to benefit from. Many investors resort to this type of pattern trading to extract maximum profit in limited conditions on the market. This pattern is relatively simple to comprehend and apply in trading, which is why it is a good fit for both experienced and novice traders.The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration. ... The USD/JPY currency pair is one of the most traded forex pairs in the world, and for good reason.

There is also a session prior to the market's open, which is called the pre-market session; Schwab clients can trade from 7 a.m. ET to 9:25 a.m. ET on Schwab.com or Schwab Mobile, or round the clock on thinkorswim by choosing an EXTO order type. Together, both pre-market and after-hours sessions ...

There is also a session prior to the market's open, which is called the pre-market session; Schwab clients can trade from 7 a.m. ET to 9:25 a.m. ET on Schwab.com or Schwab Mobile, or round the clock on thinkorswim by choosing an EXTO order type. Together, both pre-market and after-hours sessions are referred to as extended-hours trading.Extended-hours trading is made possible by computerized order matching systems called electronic markets. An electronic market is simply a service that matches up buy and sell orders. For example, if a trader places an order to buy 200 shares at $45, the computer looks to see if there is an order to sell at least 200 shares at $45.If there is, the trade is done; if not, then the order will not be filled. While commissions and settlement times are the same as for the regular session, there are several differences between regular session trading and after-hours trading. For example, in the after-hours session, not all order types are accepted.Traders can only use limit orders to buy, sell, or short. Market, stop and stop-limit orders, and orders with special conditions, such as fill-or-kill, immediate-or-cancel, or all-or-none, can't be placed. After-hours orders are good only for the particular session in which they are placed and don't carry over into any other session—unless traders are using the thinkorswim trading platform and define their time frame as "GTC_EXT," which means Good Til Canceled, including the extended hours.

The letter H is a NASDAQ exchange fifth-letter identifier for a company's stock symbol when it sells shares with a second convertible bond.

For example, the letter H is also the stock ticker symbol of Hyatt Corp. but Hyatt is not an H stock. The National Association of Securities Dealers Automated Quotations, or NASDAQ, is a global electronic marketplace for buying and selling securities as well as the benchmark index for U.S. technology stocks. NASDAQ was created by the National Association of Securities Dealers (NASD) to provide investors and traders with a computerized, speedy, and transparent system.NASDAQ Trader. "Nasdaq's List of Fifth Character Symbol Suffixes." Accessed July 4, 2021. NASDAQ. "About NASDAQ." Accessed July 4, 2021. ... The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear.The letter H appears as the last character in the symbols of certain stocks traded on the NASDAQ stock exchange.Investopedia contributors come from a range of backgrounds, and over 25 years there have been thousands of expert writers and editors who have contributed.

:max_bytes(150000):strip_icc()/h.asp-final-1-2d37eebd38964a39b3faf358bb6a60e8.png)

Welcome to TradingHours.com - The authoritative source for financial calendar reference data. Access Trading Hours, Market Holidays, Non-Settlement Dates, and Irregular Schedules for hundreds of markets around the globe

Add Market Holidays and Trading Hours data to your system. TradingHours.com provides most accurate and comprehensive financial calendar reference data available. Trusted by world-leading financial institutions and fintech companies.Trading hours and market holidays available for all major Stock Exchanges. See current trading status, countdowns, and key data.Data is carefully researched and verified from primary sources, then continuously monitored for updates to ensure the highest standards of accuracy.TradingHours.com was established in 2015 to meet the growing need for reliable, machine-readable trading hours and market holidays data.

Discover H Trading Co., Ltd., a leading Korean supplier known for eco-friendly indoor dog potty trays and superior quality products.

Company Name: H Trading Co., Ltd.Company Introduction: H Trading quickly identifies consumer demand and distributes and produces idea products based on excellent quality.We are doing our best to improve environmental problems by producing eco-friendly products and lead a safe and hygienic life in our daily lives.

Never miss a trade! ... Please note that trading hours during the holidays are subject to change based on available liquidity.

Please note that these hours differ from the exchange’s trading hours, meaning you will not be able to open or close trades outside of eToro’s specified trading hours.Stocks are moving even when the market is closed. Extended-hours trading allows you to trade before the market opens and after it closes.This page describes stock market trading hours and notifies of upcoming events of financial significance.Find detailed trading hours for global stock exchanges, commodity, indices and currency markets, along with a market calendar for market events and contract expiry dates.

Trading Session Status message – FIX 4.2 – FIX Dictionary – Onix Solutions

We track how people interact with our online web content and resources, and some of that tracking involves storing cookies on your device. By continuing to use our site you accept that you agree to this.

Unlock the secrets of h pattern trading with expert strategies for navigating the stock market effectively. Enhance your portfolio now!

Delving into the intricate world of the stock market, astute traders often seek reliable patterns to inform their trading strategies. The h pattern, a distinctive formation on stock price charts, serves as a harbinger of potential trend reversals after a significant price decline.Employing effective trading strategies, market participants deploy tools like trailing stop-loss orders, carefully aligning them above the highest preceding weekly candle on a daily chart. This safeguards investments from sudden market turns while enabling traders to set ambitious profit targets, ensuring potential gains justify the risks undertaken.To successfully identify an h pattern, traders look for a specific structure in the price charts following a sharp decline. This involves close observation for a retest of recent lows, which then leads to creating new lows, a standard sequence for this pattern.Trading psychology plays a substantial role in the development of h pattern formations. The ballet of emotions unfolds as traders initially react to a dip with a bout of buying, only to be quickly countered by the realization that the trend may not reverse. This oftentimes triggers a sell-off by those same market participants, intensifying the downtrend.

On the other hand, investors may make pre-market trades upon getting news. A good example is the highly significant monthly US employment report, which is released at 8:30 a.m. Eastern Time on the first Friday of every month.

To illustrate how this might impact your profitability, consider an example where you would like to sell 100 shares of a stock, so you place a limit order to sell at $55. During normal market hours, there might be hundreds or thousands of traders willing to buy your 100 shares at $55.Other risks include price volatility (which tends to be much higher in extended-hours trading than during normal market hours), stronger competition (greater percentage of professional traders who are more skilled at seeking best price execution for themselves), and trading limitations imposed by your broker (which can vary).While this list is not an exhaustive list of all the risks associated with trading during extended hours, they are among the most important factors to consider. At Fidelity, you can trade listed equities and OTC equities—excluding pink sheets and bulletin board stocks (i.e., those that are not listed on an exchange)—during extended hours.If you’re focused on building a diversified portfolio of high-quality stocks, bonds, and other investments, and are not comfortable with the heightened risks involved, you might be better off executing trades during normal market hours.

To be honest, it looks more like a lowercase H, which you'll see in a little bit. It's not really a capital H. As traders we try and do is we try name patterns that we can remember because there's so many patterns, so many price points, and so many pivots - why make it harder on ourselves?

It helps you trade a stock that's in a downtrend in a way that's calculated where you're not just pressing, but you're shorting a bounce. So it helps enter shorts when stocks are in a corrective phase, helps you short bounces, and then add to shorts when they break prior support, which I just showed you- that’s the H.That’s just to show you how you could have been managing this trade. This was the first opening move. I'm going to short a bounce, bounce happens into the moving averages, short more and add more, cover a little bit, it comes back up and doesn't reclaim that spot.So that is your shortable bounce, which is the bottom of the H, and then you see you’re in Tier 1, then Tier 2, then back to Tier 1 because maybe you're holding some and then you end up having downside and it is those 24.60. So by shorting a bounce, you're able to get a good price and then you can get the momentum price when it breaks the prior day low. · Remember what we said before: it needs to go below a prior low. So you could short the bounce to actively trade using tier system and cash flow where it's not all or none.Let's continue with why you would use the H Sell Setup and what would give you a clue to look for it to manage a trade to the downside.

What Happened? Shares of hospitality company Hyatt Hotels NYSE:H jumped 5.1% in the afternoon session after comments from Federal Reserve Chair Jerome Powell opened the door to potential interest rate cuts. Powell's comments at the Jackson Hole Economic Policy Symposium suggested that the central ...

What Happened? Shares of hospitality company Hyatt Hotels NYSE:H jumped 5.1% in the afternoon session after comments from Federal Reserve Chair Jerome Powell opened the door to potential interest rate cuts. Powell's comments at the Jackson Hole Economic Policy Symposium suggested that the central b…Shares of hospitality company Hyatt Hotels H jumped 5.1% in the afternoon session after comments from Federal Reserve Chair Jerome Powell opened the door to potential interest rate cuts. Powell's comments at the Jackson Hole Economic Policy Symposium suggested that the central bank could begin to cut interest rates, sparking a widespread rally across Wall Street.For cyclical companies like Hyatt, the prospect of lower interest rates is particularly favorable as it can lead to reduced borrowing costs and stimulate consumer spending on travel and leisure, boosting investor confidence in the hospitality sector.The previous big move we wrote about was 10 days ago when the stock gained 3.5% on the news that the latest Consumer Price Index (CPI) report showed inflation holding steady, bolstering investor optimism for a potential interest rate cut by the Federal Reserve.

Trading the H Pattern-Trader H is a key pattern to trade as a Trader. H’s tend to appear everywhere, so it’s important to know what you’re looking for. In my case, I look for the first leg down …

I hope this helps you understand how I trade the H patterns.I always consider my strategy, looking for a confluence of bullish indicators such as the 12/26 EMA bullish flip, resistance break, and trendline break. When these indicators align, I enter a long bullish play, recognizing the formation of a Bullish H-Pattern.I always consider my strategy, looking for a confluence of bearish indicators such as the 12/26 EMA bearish flip, support break, and trendline break. When these indicators align, I enter a short play, recognizing the formation of a Bearish H-Pattern.This is a great example. As you can see, the first leg of the H retraces and starts creating support before dropping, yet its important to understand that H trading patterns are both bullish and bearish.

The H pattern usually forms after a large bearish trend and goes up to test its recent decline. It looks like a small letter h on charts.

The H pattern usually emerges after a steep bearish trend and is notable for its distinctive shape, likened to the small letter H. That trend can span anywhere from a few minutes to a few weeks. There is also some controversy and confusion surrounding the H pattern. On January 30th, 2024, I traded and screenshot a textbook h pattern setup on a SPY one-minute chart as it progressed with nearly perfect follow-through.With practice, simply noticing the pattern at a glance will give you all of the information needed to identify price targets and formulate a trade plan. ... One of the most important things to know about the H pattern is that it is often a very short-term reversal.Statistically, it provides opportunities for a bearish trade at the end of the pattern’s development. The formula for analysis involves noting the first low, the first high, and then the second low, following the steep bearish trend’s reaction to a support level or a known demand zone.These price targets can be used to enter and exit a trade or multiple trades. It is also important to recognize that a set of probabilities will accompany each price target. First things first. Identify the H pattern.

Unlock the secrets of h pattern trading with expert strategies for navigating the stock market effectively. Enhance your portfolio now!

Delving into the intricate world of the stock market, astute traders often seek reliable patterns to inform their trading strategies. The h pattern, a distinctive formation on stock price charts, serves as a harbinger of potential trend reversals after a significant price decline.Employing effective trading strategies, market participants deploy tools like trailing stop-loss orders, carefully aligning them above the highest preceding weekly candle on a daily chart. This safeguards investments from sudden market turns while enabling traders to set ambitious profit targets, ensuring potential gains justify the risks undertaken.To successfully identify an h pattern, traders look for a specific structure in the price charts following a sharp decline. This involves close observation for a retest of recent lows, which then leads to creating new lows, a standard sequence for this pattern.Trading psychology plays a substantial role in the development of h pattern formations. The ballet of emotions unfolds as traders initially react to a dip with a bout of buying, only to be quickly countered by the realization that the trend may not reverse. This oftentimes triggers a sell-off by those same market participants, intensifying the downtrend.

:max_bytes(150000):strip_icc()/h.asp-final-1-2d37eebd38964a39b3faf358bb6a60e8.png)