Advanced Market Analysis Tools

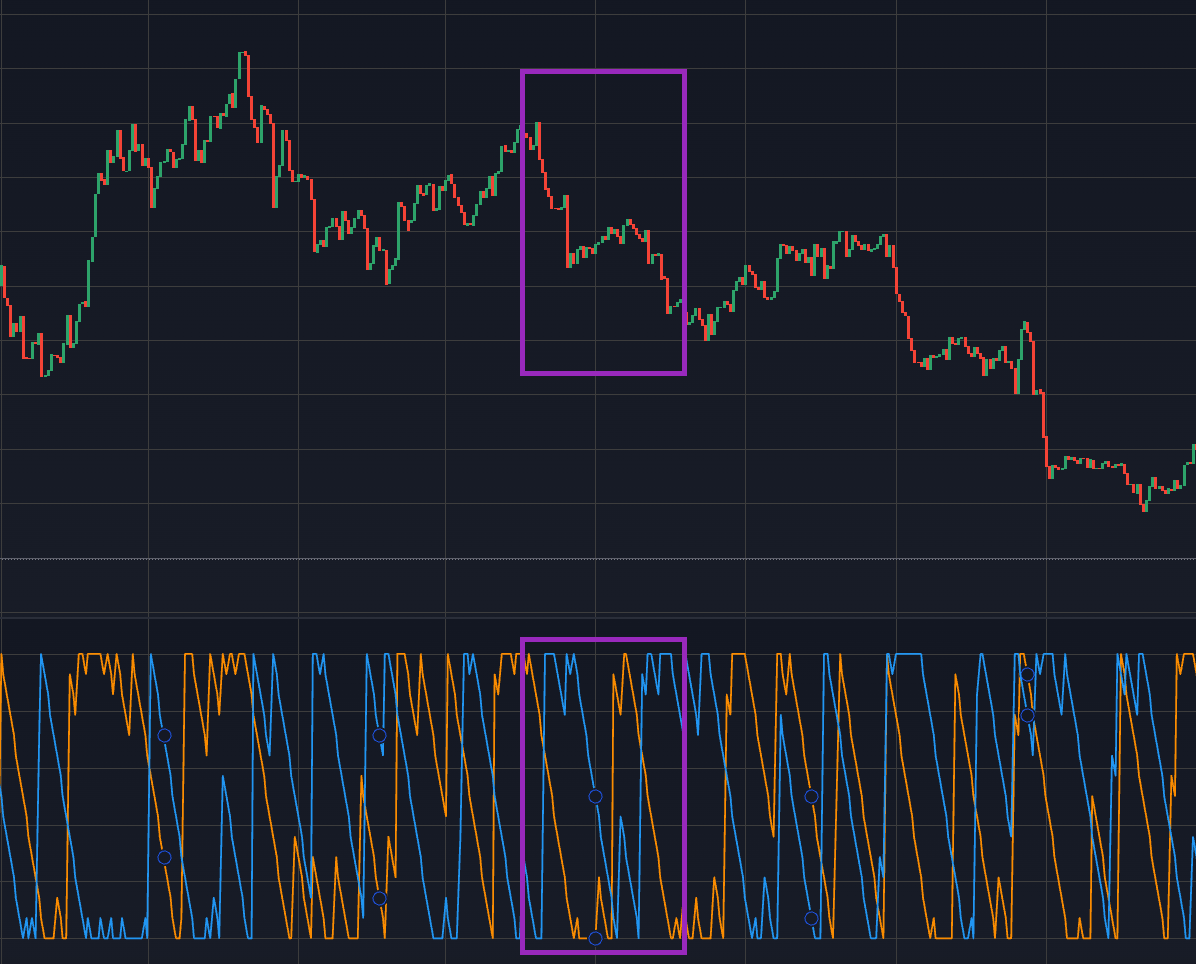

Professional trading platforms provide sophisticated analytical tools that enable traders to make informed decisions based on comprehensive market data. These tools include real-time charting capabilities, advanced technical indicators, and algorithmic trading support that can significantly enhance trading performance.

Modern trading environments integrate artificial intelligence and machine learning algorithms to identify market trends and predict potential price movements. These technological advances allow traders to process vast amounts of market data quickly and efficiently, providing competitive advantages in fast-moving markets.

The integration of fundamental analysis tools with technical indicators creates a comprehensive trading approach. Economic calendars, earnings reports, and geopolitical event tracking help traders understand the broader market context that influences price movements across different asset classes.